College Savings and Scholarships Guide

Price is among the most important factors students and their families consider when selecting a college. Increasing costs limit students’ choices, and a wrong decision could lead to extreme debt.

However, many helpful financial options are available for families, from savings accounts to scholarships. Continue reading to learn more about potential opportunities with insight from a current college student.

College Savings Options

Savings accounts are available for students and families to help prepare for the cost of college. Plans differ depending on the purpose and income of those involved.

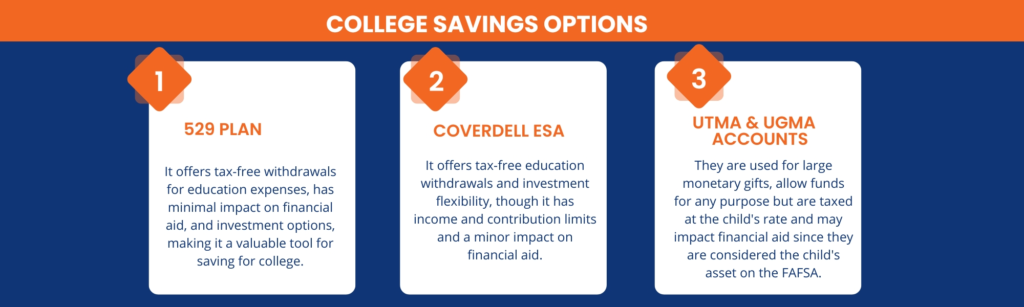

529 Plan

The 529 education savings plan is very popular. This plan’s funds are exclusively for education. This account’s money can cover tuition, room and board, and other expenses like textbooks. However, using funds for other purposes will result in a 10% penalty.

It is not considered a student’s asset on the Free Application for Federal Aid (FAFSA). This means it has a minimal effect on the student’s financial aid offered.

After opening a 529 plan, investment options are available based on your goals and when the student will need the funds. If you are not familiar with investing, this plan is very helpful.

One major benefit is the tax-free withdrawals. Also, money from this account is sent directly to the school, which limits unnecessary transactions and stress.

When I was born, my family opened a 529 plan. This plan, as well as its investment guidance, helped my family afford college.

Coverdell ESA

A Coverdell Education Savings Account is another option to consider. This account is also strictly for educational purposes.

This plan also includes tax-free withdrawals. The FAFSA considers it a parent asset, which has a minor impact on the financial aid a student may receive.

Unlike 529 plans, the Coverdell ESA has financial limitations. To be eligible for an account, an individual’s income must be below $110,000 annually, or under $220,000 for married couples. In addition, there is a contribution limit of $2,000 per year.

This account does not offer structured investing options, which allows for more investment flexibility.

UTMA and UGMA Accounts

The Uniform Transfers to Minors Act (UTMA) and the Uniform Gifts to Minors Act (UGMA) are additional ways to save money for college.

These accounts are commonly used when a child receives a large monetary gift. Money in this account can be used for any purpose.

A small portion of this plan is taxed at a child’s rate. If the funds exceed $2,500, they are taxed at the parent’s rate.

This account becomes fully owned by the child when they reach an age between 18 to 25 and is considered an asset of the child on the FAFSA. Be aware that this may lower the financial aid awarded to the student.

The Best Option

While all options available can be used to save and invest funds for college, each has individual benefits and drawbacks. Look at your family’s goals to find which options work best for you.

A family with a lower income may opt for a Coverdell ESA. For someone looking for guidance on investing, a 529 plan can help.

Decide if these funds are strictly for educational purposes and look into the effects of claiming the account on the FAFSA.

Scholarships

Scholarships are an additional way to decrease the financial burden of college. Universities offer these funds for multiple reasons.

The first reason is based on merit. A student’s skills, grades, and test scores may qualify them for additional money.

Need-based scholarships are also available. These are based on a family’s income and their Expected Family Contribution from the FAFSA.

There are many types of need-based aid. Most commonly, state and federal grants are used. Pell Grants are similar but reserved for lower-income students.

Loans available to the student are also decided based on need. Remember that, unlike grants, loans need to be repaid.

Work-study jobs are also examples of need-based assistance. These are jobs within the university that allow students to earn money for their tuition. I was eligible for a work-study job in my freshman year. I worked in my university’s communications department. The additional income was extremely beneficial, and I gained experience in a field I am interested in.

Athletic scholarships are offered to students to play a sport for the school. This requires communication with recruiters and committing to the team.

My school does not offer merit-based aid but fulfills all my need-based aid. This greatly eliminated the financial burden on my family and was a major factor in my decision to attend. Research can help determine what is typical of each school, which is especially important if you plan to make an early decision.

Searching for Scholarships

Award letters outline the aid from each school based on the FAFSA. Colleges may have additional scholarships to apply for on their website.

The student’s high school may offer scholarships as well. My high school awarded multiple scholarships to students, each with a different purpose and unique requirements. My counselor also offered resources with scholarships available in my community. One was only open to women in the public school district I attended. Specific scholarships like this are a great choice to apply for.

Local organizations in your community may have scholarships as well. For example, my bank awards a scholarship every year.

Use external websites to look for other opportunities. Small, specific scholarships often have less competition. Look for awards aimed at a sport you played, your intended major, or extracurriculars. Make sure you meet the requirements before taking the time to apply.

Applying for Scholarships

With knowledge about different scholarships and where to find them, the next step is to apply.

Scholarships and college applications are very similar. They require a transcript, a GPA, and a list of extracurricular activities. You already have this information if you have completed the Common Application.

Most applications require an essay. This may be like your personal statement or a more specific, supplemental essay. I had prompts about my major, my intended career path, and questions specific to what I was applying for.

Use the essays to highlight a unique aspect of your identity and showcase your writing skills. Show genuine interest in and research the organization.

Letters of recommendation are often requested as well. I asked for letters from my high school counselor, math teacher, and the faculty advisor for a leadership club I was in. I requested a letter for college applications and a scholarship version. Be sure to ask in advance so they have time to complete your letter.

Students may be invited for an interview. This is a great way to show your personality and how the award would help you achieve your goals. I had an interview for a scholarship, and I appreciated the chance to connect with the people in person.

Tips

Stay organized to keep track of important scholarship deadlines.

I focused on college applications before scholarships because award letters helped me understand my financial situation first.

Top5 Colleges help streamline this process and determine how much financial aid you may receive from each school. This information lets you decide how many additional scholarships to apply for.

While researching, creating savings accounts, and applying for scholarships may be time-consuming, it is favorable compared to accumulating major debt while in school.

Read our blog “Navigating the High School to College Transition: A Comprehensive Guide” for a step-by-step high school to college transition guide.

Sources

- https://www.savingforcollege.com/article/6-ways-you-can-save-for-college

- https://studentaid.gov/understand-aid/types/scholarships

- https://www.investopedia.com/understanding-scholarships-need-and-merit-4783132#:~:text=between%20need%20vs.-,merit%2Dbased%20scholarships%3F,of%20other%20talents%20and%20criteria.